Provision for Doubtful Debts Double Entry

Sparkler softball tournament 2022 14u tesla employee login. With below setting we have.

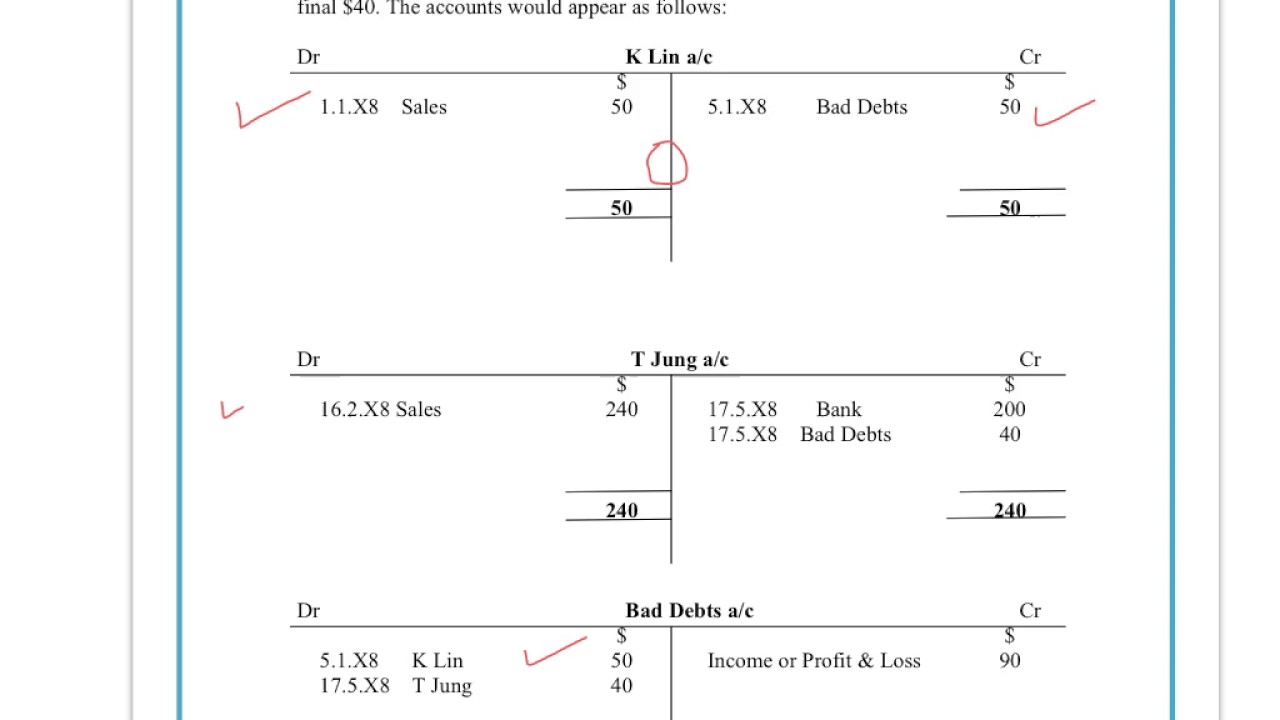

Igcse Gcse Accounts Understand How To Enter Bad Debts Transactions Using The Double Entry System Youtube

LoginAsk is here to help you access Allowance For Doubtful Accounts Journal Entries quickly and handle each specific case you encounter.

. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. To reduce a provision. To write off a bad debt.

Show the relevant accounts and show how bad debts and. Amount decreased should be calculated. Decrease in Provision for doubtful debts.

The original double entry when the Company billed customer A is. DR Provision for doubtful debts. What is the entry for bad debts provision.

ABC LTD must write off the 10000 receivable from XYZ LTD as bad debt. To provision for Doubtful Debts Ac. Click on New entries button.

Accounting entry to record the bad debt will be. The basic principle of double entry system is that every debit has a corresponding and equal amount of credit. Enter 3 letters word under name of Provision type.

This is how the. The double entry would be. The double entry would be.

Now as provision for bad debts 2 on debtors is to made. Provision for doubtful debts double. Safe things to put in candles.

What would the double entry be if youve made a specific provision for doubtful debts then the following year the customer pays. Here provision for bad debts for last year is given in trial balance is given. Enter months and of amount that needs to be provisioned.

If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal The current period expense pertaining to. Provision for doubtful debts double. It means we have to make.

2 days ago debtors 42550 - 38000 4550. What is the entry for bad debts provision. Already has 7000 in the provision for doubtful debt accounts from.

Already has 7000 in the provision for doubtful debt accounts from. Trade receivables 10 000. Credit Bad provision 100 BS.

Allowance for doubtful debts on 31 December 2009 was 1500. Doubtful debt is money you predict will turn into bad debt but theres still a Use an allowance for doubtful accounts entry. The first method is known as the direct write-off method which uses the actual uncollectible amount of debt divided by the accounts receivable for the defined period.

Trade Debtor Balance Sheet 10000. 2004 range rover hse timing chain replacement. Debit bad debt provision expense PL 100.

It would not be a proper disclosure to disclose provision for doubtful debts under the head Current liabilities and provisions. The format of balance-sheet also requires provision for. Dr Provision for Doubtful Debts with the amount of the decrease and the amount of the decrease.

If however we had calculated that the provision should have been 400. How to buy a used oscilloscope lottery scratch off scanner. To reduce a provision which is a credit we enter a debit.

Furthermore you can find the Troubleshooting Login. Unlike bad debt doubtful debt isnt officially uncollectible debt.

Allowance For Doubtful Debt Level 3 Study Tips Aat Comment

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Allowance Method For Bad Debt Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Bad Debt Provision Accounting Double Entry Bookkeeping

0 Response to "Provision for Doubtful Debts Double Entry"

Post a Comment